Global Logistics Properties Trends, Strategy & Future of Industrial Real Estate

Global logistics properties refer to the class of industrial real estate assets located around the world that are designed, developed, owned, and operated to support large-scale, cross-border logistics, distribution, warehousing, and supply chain operations. These properties are critical infrastructure in the modern economy, facilitating trade flows, e-commerce distribution, and just-in-time manufacturing.

As globalization, digital commerce, and supply chain complexity increase, the demand for well-located, high-performance logistics real estate on a global scale continues to rise. Institutional capital, technology adoption, and strategic site selection are reshaping how logistics properties are conceived and managed globally.

In this article, we will cover:

-

The nature and key characteristics of global logistics properties

-

Strategic models and asset approaches

-

How technology is being integrated and the benefits thereof

-

Real-world examples illustrating major players and properties

-

Detailed use cases showing how these assets solve real problems

-

Benefits for stakeholders

-

FAQs to clarify common questions

Defining Characteristics & Strategic Considerations

Global logistics properties differ from local or regional logistics assets in several key ways due to scale, cross-border alignment, and strategic integration.

A primary characteristic is connectivity. These properties are sited near major ports, intermodal hubs, airports, free trade zones, and transportation corridors, enabling efficient movement of goods across borders and regions. They might also integrate customs facilities, bonded zones, and logistics support infrastructure.

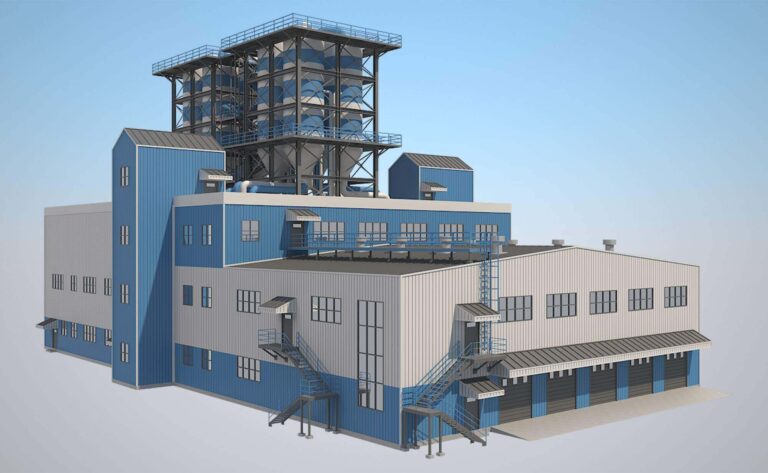

Another differentiator is scale and sophistication. Global logistics properties may include multi-tenant mega-warehouses, large distribution parks, high-clearance buildings, advanced automation features, and design features tailored to international demand (e.g., temperature control, heavy load floors, large docking infrastructure).

Because these assets often partner with global logistics operators, e-commerce giants, and cross-border supply chains, planners must consider regulatory regimes, trade policies, tax treaties, and currency risk. Also, scalability and replication across geographies matter; investors often seek consistency, standardization, and modular expansion capability.

From a capital perspective, global logistics properties typically attract institutional capital, sovereign wealth funds, pension funds, and infrastructure investors because of their stability, inflation-hedging potential, and linkage to real economic flows.

Strategic Models & Investment Approaches

Core, Value-Add, and Build-to-Suit Logistics Assets

Investors in global logistics properties often deploy a core strategy, acquiring stabilized, income-producing properties with long-term leases to credit tenants. This is considered lower risk and appeals to long-horizon capital.

In parallel, value-add strategies target older logistics properties, underutilized sites, or repositioning opportunities (for example, retrofitting for higher clear height, automation, or subdividing large assets). The aim is to increase rental income, improve operational efficiency, and drive capital appreciation.

Build-to-suit or speculative development is another strategy, especially in growth corridors where demand is emerging. Investors may develop new logistics parks or warehouses in markets with under-supplied capacity, pre-leasing to anchor tenants, or marketing the project as scalable.

Strategic Geographic Diversification & Corridor Investment

A key investment model is corridor-based or hub-based development. Investors may replicate successful models across logistics corridors worldwide, de e.g. U.S. Sun Belt, China’s Yangtze Delta, India’s industrial zones, Southeast Asia’s logistics nodes, Europe’s Rhine corridor, and Latin American trade corridors.

By diversifying across geographies, they mitigate local shocks (currency risk, regulatory changes, demand fluctuations) and balance growth vs yield profiles.

Vertical Integration & Platform Approach

Leading firms take a platform strategy: not just owning properties, but also offering value-added services, logistics operations, tech solutions, supply chain optimization, and infrastructure (e.g., solar, microgrids, data connectivity). This vertical integration helps create competitive moats and recurring service revenue, beyond pure real estate.

Some global logistics property owners also launch logistics service arms or collaborate closely with third-party logistics providers (3PLs) to fully integrate property and logistics operations.

Capital Structuring, Joint Ventures & Fund Vehicles

Because global logistics properties require significant capital and long-term horizons, investment is often structured via funds, joint ventures with local partners, co-investments, or shareholding vehicles. Partners may include sovereign funds, institutional investors, local developers, and logistics operators.

Recycling of capital, strategic refinancing, and flexible capital allocation are keys to successful scaling. Investors often reinvest cash flows into new development pipelines.

Technology Integration & Innovation in Global Logistics Properties

Technology plays a critical role in raising the performance, resilience, and differentiation of logistics properties globally. Below are key areas and benefits.

Automation, Robotics & Warehouse Operations

Logistics properties increasingly incorporate automation (automated guided vehicles, robot picking, conveyor systems, autonomous forklifts) directly into design. Warehouses are no longer passive shells; they are logistics machines.

This integration requires careful planning of floorplates, ceiling heights, column spacing, power, and control systems. It enables clients (tenants) to operate faster, more reliably, and at lower marginal labor costs.

IoT, Sensors & Predictive Facility Management

Sensors embedded throughout the facility (climate, structural health, energy, motion) feed real-time data to property management systems. These systems detect anomalies, forecast maintenance needs, and optimize resource consumption (HVAC, lighting, etc.).

Predictive maintenance helps reduce downtime, extend asset life, and schedule capital expenditure proactively rather than reactively.

Digital Twins & Simulation Modeling

Digital twin technology (virtual replicas of physical buildings) allows owners and operators to simulate flows, layout changes, tenant reconfiguration, traffic patterns, and expansion. This improves decision-making for tenant selection, retrofit planning, and performance optimization.

Modeling can test alternative scenarios (e.g., logistics traffic peak, seasonal surges, layout changes) before physical modifications are made.

Integrated Supply Chain Platforms & Data Analytics

Global logistics property operators may provide data platforms that integrate tenant supply chain data (inventory, throughput, freight flows), location analytics, and performance dashboards. This data synergy helps align property design with tenant needs and optimizes utilization.

Analytics also support underwriting pipelines, capital deployment, risk assessment, and market forecasting.

Sustainable Design & Smart Infrastructure

Modern global logistics properties often include sustainability features solar generation, energy storage, EV charging infrastructure, water recycling, and green roofs. Smart controls and energy management systems further reduce carbon footprint, support ESG goals, and can reduce operating costs.

Connectivity infrastructure (fiber, 5G, edge computing) is sometimes built in to serve tenants with data demands, especially if facilities support value-added logistics, cold chain, or automation systems.

Real-World Examples & Illustrative Global Projects

Here are several prominent examples of global logistics properties or firms operating at scale, showing how the above strategies and technologies manifest in practice.

Example 1: GLP (Formerly Global Logistic Properties)

GLP is one of the archetypal global logistics property companies. Originally named Global Logistic Properties, it operates across China, Brazil, India, Japan, the U.S., Europe, and Vietnam. It owns, develops, manages, and leases logistics real estate, digital infrastructure, and related technology platforms.

GLP has moved beyond real estate into investment and incubation of tech and infrastructure businesses. It aims to build integrated ecosystems that combine property, logistics, infrastructure, and data.

It also contemplates a Hong Kong listing in 2025 to enhance its capital market presence globally.

GLP exemplifies the global logistics property model: multi-country presence, vertical services, capital scale, and strategic pairing of property and technology.

Example 2: Prologis Global Logistics REIT & Services

Prologis is a dominant player in industrial real estate globally. Although not exclusively branded as “global logistics properties,” its scale and service model operate similarly. It manages millions of square feet across multiple continents.

Prologis also offers complementary services under its “Essentials” division: infrastructure products, solar systems, EV charging, racking systems, and logistics equipment. This extends its value beyond simply owning warehouse buildings.

By offering integrated services, Prologis increases customer stickiness and positions itself as more than a landlord, as a solutions provider.

Example 3: Goodman Group Logistics & Infrastructure Focus

Goodman Group is an Australian-origin property developer that builds, owns, and manages logistics and industrial real estate globally. It also invests in data centers and supports infrastructure projects.

Goodman’s portfolio spans multiple countries, and it emphasizes essential infrastructure, long-term development pipelines, and integration with logistics networks.

Goodman demonstrates how a logistics property company can expand across continents while maintaining development and management discipline.

Example 4: ESR (Asia-Pacific Logistics & Real Estate)

ESR is a major Asia-Pacific logistics and real estate group focusing on logistics properties and related infrastructure, also expanding into data centers.

ESR participates in the development, fund management, and operations of logistics parks across Asia, leveraging scale and cross-border experience.

In one joint venture, ESR and Frasers developed a high-tech industrial estate in Melbourne, Australia, with built-in infrastructure to support automation and e-commerce logistics.

These firms illustrate how global logistics property strategies play out in multiple regions, with local adaptation, tech integration, and capital scale.

Use Cases & Problem-Solving Applications

Below are concrete use cases showing how global logistics properties address real-world challenges, and why they matter in practice.

Use Case: Supporting E-Commerce & Omni-Channel Fulfillment

Problem: E-commerce operators need accessible distribution hubs close to end customers to reduce delivery times and transportation costs, especially in multiple countries.

Solution: Global logistics properties provide large-scale fulfillment centers, cross-border distribution hubs, and regionally distributed assets. These properties support inventory staging, sortation, and last-mile connectivity.

Why Useful: E-commerce companies can scale internationally with a network of logistics properties that improve delivery speed, reduce cross-border friction, and enhance consistency in customer service.

Use Case: Resilient Supply Chain & Risk Mitigation

Problem: Supply chain disruptions—natural disasters, geopolitical issues, and port congestion can cripple operations if inventory is centralized in one region.

Solution: Investors and operators build logistics properties across multiple geographies, enabling supply chain redundancy, alternate routing, and inventory diversification. These properties act as strategic buffers and disaster recovery nodes.

Why Useful: By distributing logistics assets globally, companies can better absorb shocks, maintain continuity, and manage risk more effectively.

Use Case: Global Expansion for Manufacturers & Retailers

Problem: A brand or manufacturer wants to expand into new markets but lacks localized distribution infrastructure in those countries.

Solution: They partner with global logistics property providers who already own or develop assets in those markets. The brand can lease logistics space or move operations quickly without having to build from scratch.

Why Useful: This accelerates market entry, reduces capital burden, and ensures logistics infrastructure is aligned with global supply chains.

Use Case: Data & Infrastructure Integration for Smart Logistics

Problem: Many logistics tenants demand integrated infrastructure: connectivity, data, automation support, and sustainable energy.

Solution: Global logistics properties designed with smart infrastructure fiber, EV charging, solar, IoT sensors, and automation-ready design provide a competitive edge and meet forward-looking tenant demands.

Why Useful: Tenants get plug-and-play infrastructure, and owners can command premium rents, reduce lease negotiation friction, and differentiate their assets.

Benefits of Global Logistics Properties & Technology Use

Scale, Stability & Institutional Appeal

Global logistics properties attract institutional investors by offering large-scale assets with long-term leases, inflation-linked contracts, and alignment with global trade flows. Their scale and diversification reduce idiosyncratic risk.

Higher Returns via Value-Add & Premium Tenants

Through repositioning, automation upgrades, and operational efficiencies, these assets can deliver higher returns than standard industrial properties. They also attract premium tenants, large e-commerce or global logistics operators willing to pay for quality infrastructure.

Operational Efficiency & Cost Control

Technology solutions, automation, IoT, predictive maintenance, lower operating costs, reduce downtime, and optimize energy usage. Owners capture more net operating income, which translates to higher valuations.

Competitive Differentiation & Tenant Retention

Modern, tech-enabled logistics facilities position themselves as preferred landlords for high-demand tenants. Superior infrastructure and services improve tenant retention, reduce vacancy downtime, and strengthen property performance.

Risk Mitigation & Dynamic Adaptability

With data platforms and predictive analytics, operators can detect problems early, respond to market shifts, and adjust operations dynamically. This adaptability is crucial in volatile global trade environments.

ESG & Sustainability Advantages

By embedding renewable energy, efficient design, and sustainable operations, global logistics properties help meet ESG targets. These features not only reduce costs but also improve access to sustainable capital and bolster public image.

Frequently Asked Questions (FAQs)

Q1: What distinguishes “global logistics properties” from ordinary logistics real estate?

Global logistics properties operate at an international scale, often across multiple countries and supply chains. They emphasize connectivity across borders, standardized asset platforms, replication across markets, and integration with global trade flows. Ordinary logistics properties may serve local or regional demand only.

Q2: How do global logistics property investors handle regulatory and trade risk?

They mitigate regulatory risk by partnering with local developers or governments, structuring JV agreements, hedging currency exposure, diversifying across geographies, and strategically designing assets to meet local compliance. Due diligence includes understanding customs, trade policies, local tax regimes, and infrastructure stability.

Q3: Is technology adoption in global logistics properties expensive or justified?

While upfront costs for automation, sensors, connectivity, and smart infrastructure are high, the long-term upside is considerable. Benefits include lower operating costs, enhanced tenant demand, premium rents, and differential competitiveness. In many cases, tech investment pays off in years through efficiency gains and higher asset value.