Industrial Real Estate Investing Strategies, Benefits & Real-World Use Cases

Industrial real estate investing refers to owning and managing properties used for manufacturing, warehousing, or logistics. This sector has seen rapid growth as global e-commerce expands, supply chains evolve, and investors seek stable, inflation-resistant returns.

This article explores what industrial real estate investing is, why it matters, how technology shapes its future, and real examples showing its value in modern economies.

Understanding Industrial Real Estate Investing

Types of Industrial Properties

Industrial real estate includes several categories:

-

Warehouses – spaces used for storing and distributing goods.

-

Distribution Centers – large-scale hubs for logistics operations and cross-docking.

-

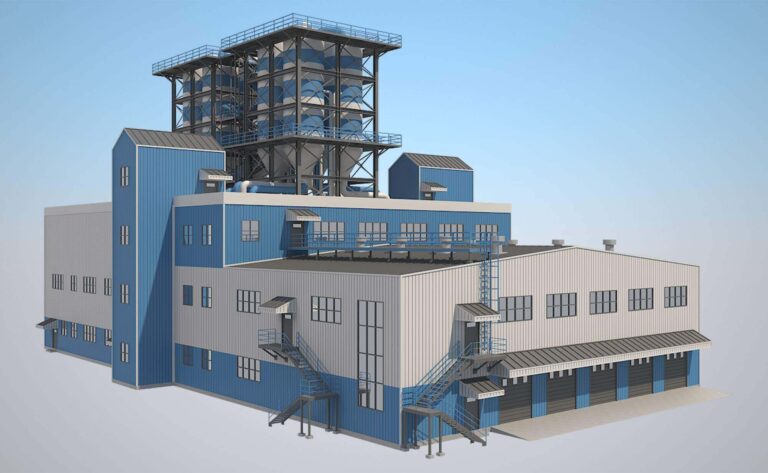

Manufacturing Facilities – properties built for production or light assembly.

-

Flex Industrial Buildings – mix of office and small manufacturing or storage.

-

Cold Storage Units – facilities for temperature-controlled goods like food or pharmaceuticals.

Each property type serves unique industries, influencing location, design, and tenant demand.

Key Investment Metrics

Investors typically evaluate industrial assets using:

-

Net Operating Income (NOI): rental income minus operating costs.

-

Cap Rate: percentage of income relative to purchase price.

-

Lease Structure: often long-term and triple net (tenant covers taxes, insurance, maintenance).

-

Tenant Credit Strength: ensures consistent cash flow.

-

Location & Accessibility: proximity to transport hubs boosts value.

These factors determine yield stability and long-term appreciation.

Why Industrial Real Estate Is a Strong Investment

E-commerce and Supply Chain Growth

The boom in online shopping has transformed retail logistics. Companies now need vast warehouse networks and last-mile facilities to ensure fast delivery. As demand grows, industrial properties have become essential infrastructure.

Predictable and Long-Term Income

Industrial tenants often sign leases lasting 10–20 years because operations rely heavily on customized spaces. With triple net structures, landlords enjoy steady income and fewer maintenance costs.

Lower Turnover and Maintenance

Unlike retail or office spaces, industrial properties experience minimal cosmetic wear. Tenants usually handle upgrades, reducing landlord expenses and ensuring longer occupancy periods.

Portfolio Diversification

Industrial assets provide stability even in economic downturns. They behave differently from retail or office sectors, balancing risk across a diversified investment portfolio.

Challenges in Industrial Real Estate Investing

Single-Tenant Dependency

Many properties rely on one tenant, increasing vacancy risk when that tenant leaves. Releasing such spaces may require expensive modifications.

Technological Obsolescence

Older facilities without modern infrastructure (e.g., automation compatibility or high ceilings) may become less desirable. Regular upgrades are essential to remain competitive.

Oversupply in Certain Markets

Rapid development in industrial zones can lead to oversupply, reducing rental growth and asset value.

Long Investment Horizon

Industrial properties require patience. Returns compound over years rather than months, making them ideal for long-term investors.

The Role of Technology in Industrial Real Estate

Smart Sensors and IoT

IoT devices now monitor temperature, energy, and maintenance systems. These sensors detect issues before they escalate, reducing downtime and operating costs.

Automation, like robotic conveyors and autonomous forklifts, improves productivity and lowers labor costs, making facilities more efficient and appealing to tenants.

Data Analytics and AI

AI-driven tools help investors assess market demand, predict rental trends, and evaluate tenant risks. Predictive analytics identify high-performing locations before competitors.

Digital Twins and Virtual Tours

Virtual reality allows tenants to tour warehouses remotely, visualize layouts, and plan operations, accelerating leasing and reducing marketing costs.

Green Technologies

Sustainable systems like solar roofs and energy management platforms reduce carbon footprints and attract eco-conscious tenants while improving long-term asset value.

Real-World Use Cases

Example 1: Prologis Logistics Parks

Prologis develops global logistics parks optimized for e-commerce fulfillment. Their warehouses feature renewable energy, charging docks, and advanced management systems.

Relevance: These properties highlight how combining technology and sustainability boosts occupancy rates and investor returns.

Example 2: Amazon Fulfillment Centers

Amazon operates robotic warehouses designed for speed and efficiency.

Relevance: Demonstrates the crucial link between technology, consumer demand, and industrial property value.

Example 3: Cold Storage Facilities

Cold storage properties serve temperature-sensitive industries.

Relevance: Limited supply and specialized infrastructure create strong pricing power for investors.

Example 4: Urban Micro-Warehouses

These compact facilities near city centers cater to same-day delivery networks.

Relevance: Urban logistics growth drives higher rents and consistent demand for well-located micro-warehouses.

Practical Benefits & Real Use Cases

Supporting E-commerce Expansion

Industrial assets enable fast order fulfillment and efficient delivery, directly supporting online retailers’ growth.

Strengthening Supply Chains

Investors in strategically located industrial parks help companies reduce dependence on distant suppliers, increasing resilience during global disruptions.

Sustainable Value Creation

Energy-efficient buildings not only reduce costs but also align with ESG investment strategies.

Reducing Operational Risks

Automation and predictive maintenance technologies reduce human error and downtime, ensuring consistent performance and tenant satisfaction.

Strategic Tips for Investors

-

Choose locations near major ports, highways, or airports.

-

Favor flexible spaces that adapt to tenant changes.

-

Invest in assets supporting automation and sustainability.

-

Maintain tenant diversity to spread risk.

-

Focus on active management for long-term appreciation.

FAQs

Q1: Is industrial real estate only for big investors?

Not necessarily. Smaller investors can access industrial REITs or fractional ownership platforms specializing in warehouses and logistics properties.

Q2: Why are leases usually long-term?

Tenants invest heavily in equipment and facility customization, so they prefer multi-year contracts for operational stability.

Q3: How does technology improve property value?

Smart automation, data monitoring, and energy efficiency enhance tenant satisfaction, reduce costs, and increase property desirability, leading to better ROI.

Conclusion

Industrial real estate investing stands as one of the most resilient and profitable sectors today. Driven by e-commerce, automation, and sustainability, it provides steady income, long-term capital growth, and portfolio diversification.

For investors seeking tangible, tech-ready assets that meet global demand, industrial real estate remains a cornerstone of modern investment strategy.