Real Estate Management Business Strategy, Technology & Real-World Insights

A real estate management business (also often called a property management business) is the enterprise that oversees, operates, and enhances real estate assets on behalf of owners. Whether managing residential apartment complexes, commercial offices, retail malls, industrial warehouses, or mixed-use developments, these businesses act as the bridge between property owners and tenants, performing a wide range of roles from leasing to maintenance, financial oversight, compliance, and strategic asset improvement.

In today’s evolving market, a real estate management business must combine operational excellence, technology, tenant experience, and strategic insight. In this article, we will delve deeply into what makes a real estate management business function well, the core responsibilities, the role of technology, illustrative real-world use cases, the benefits, practical problem-solving examples, and frequently asked questions.

What Is a Real Estate Management Business & Why It Matters

Definition and Business Model

A real estate management business is a firm that provides ongoing services to property owners by managing the daily operations and long-term optimization of real estate assets. The business model typically earns revenue via property management fees (a percentage of rent or fixed fee), leasing commissions, maintenance or service markups, and sometimes performance or incentive fees.

The business takes on tasks the owner either cannot or does not wish to manage directly: tenant screening, rent collection, lease renewals, preventive maintenance, capital project oversight, dispute resolution, and regulatory compliance. By delegating these responsibilities, property owners can scale their portfolios without being weighed down by operational detail.

Why the Real Estate Management Business Is Essential

A well-run management business preserves and enhances the value of real estate assets. Properties, even well-located ones, degrade without care, and tenant satisfaction is critical to minimize turnover. A professional management firm ensures that tenants are served, systems are maintained, costs are controlled, and long-term value is protected.

Furthermore, property owners, especially investors or institutional owners, often lack local presence, specialized technical staff, or time to handle the operational complexities. A real estate management business fills that gap, delivering consistency, accountability, and local expertise at scale.

Core Responsibilities & Operations

Tenant Acquisition, Lease Management & Relations

One of the foundational responsibilities is to market vacancies, screen prospective tenants, negotiate leases, and manage renewals. Tenant screening includes background checks, credit checks, rental history verification, and ensuring fit with property rules or use restrictions.

Lease agreements must define responsibilities clearly repairs, utilities, maintenance, common area charges, and termination clauses. Once tenants occupy, the management business handles move-ins, onboarding, tenant relations, and ongoing communication about property policies or changes.

Dealing with tenant issues, complaints, repairs, conflicts, and enforcing lease terms is a continuous function. A successful management business maintains transparency, responsiveness, and fairness to foster long-term relationships and lower turnover.

Maintenance, Repairs & Capital Projects

Physical upkeep is critical. The management business organizes preventive maintenance (routine inspections, system servicing), reactive repairs, vendor coordination, emergency response, and capital improvement projects (roof replacement, HVAC overhaul, plumbing upgrades).

A strong firm maintains lifecycle schedules, tracks maintenance logs, forecasts capital expenditures, and phases projects to avoid tenant inconvenience. It also negotiates vendor contracts and monitors performance to keep costs under control while maintaining quality.

Financial Oversight & Reporting

The management business handles all financial aspects: rent collection, expense payments, budgeting, forecasting, cash flow, and financial reporting to owners. They reconcile accounts, produce income statements and balance sheets, and alert owners to variances or needed adjustments.

They also manage security deposits, accounts receivable (arrears), and undertake collection or eviction processes if needed (in compliance with local law). Transparent reporting builds trust with owners, particularly in multi-property portfolios.

Compliance, Risk & Legal Management

Real estate management must comply with local, regional, and sometimes national regulations, landlord-tenant laws, building codes, safety standards, environmental rules, and zoning. A management firm must stay current with regulatory changes, obtain necessary permits, coordinate inspections, and ensure safety and insurance coverage.

Risk mitigation includes liability management, tenant insurance requirements, safety audits, emergency planning, and responding to incidents (fires, floods, structural issues). Legal oversight is essential: drafting lease clauses, handling disputes, and ensuring the business and owners are protected.

Strategic Asset Management & Value Enhancement

Beyond day-to-day operations, the management business should add strategic value: recommending property improvements, repositioning, rent escalations, tenant mix optimization, repositioning marketing, or redevelopment. The ability to identify underutilized spaces, propose upgrades, and execute capital projects gives owners a competitive advantage.

In many cases, the management business becomes an advisor or co-partner in value-add strategies, shaping long-term property vision, not just maintaining it.

Technology’s Role in the Real Estate Management Business

Technology is not optional; it is a differentiator. Leading real estate management firms adopt integrated systems and digital tools to enhance efficiency, transparency, and scale.

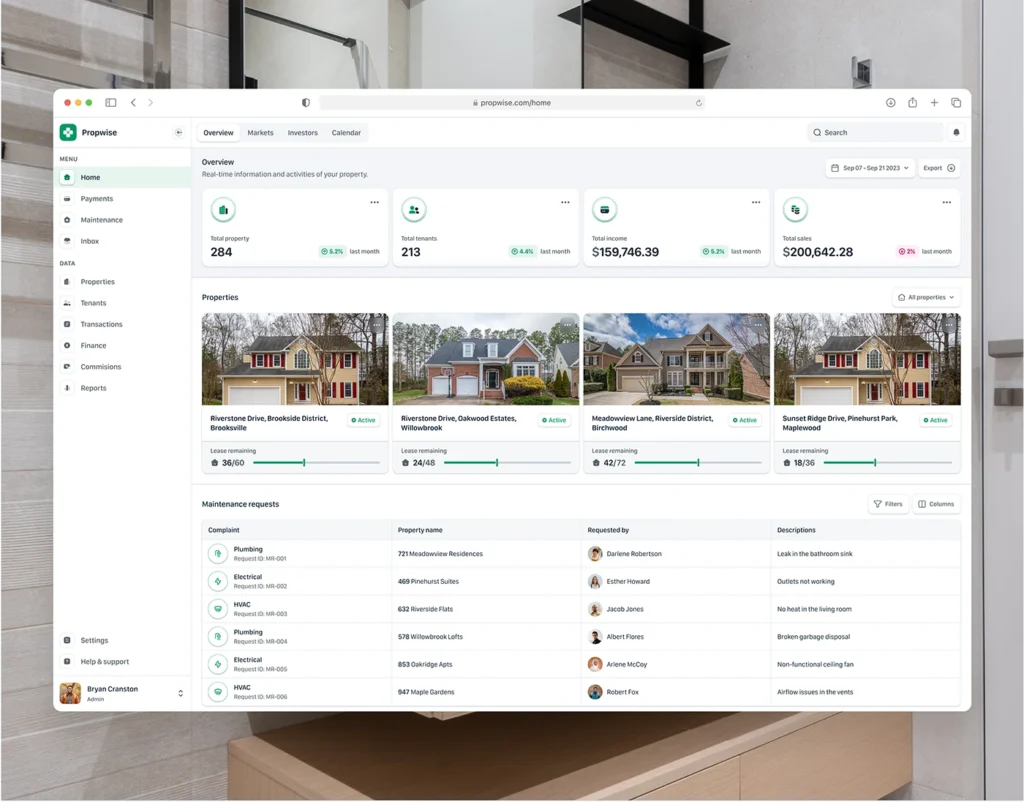

Property Management Platforms & Integrated Systems

Sophisticated property management software (often part of Integrated Workplace Management Systems, IWMS) centralizes leasing, accounting, maintenance ticketing, tenant communications, asset tracking, and more. These platforms reduce silos, improve data visibility, and support decision-making.

With integrated systems, management firms can track performance KPIs, compare properties, identify cost anomalies, and scale operations across multiple sites seamlessly.

IoT, Sensors & Predictive Maintenance

Smart sensors monitor building sy, HVAC, plumbing, energy use, occupancy, and structural health—and feed data into predictive algorithms. Instead of waiting for breakdowns, maintenance is scheduled proactively, reducing downtime and costs.

For example, sensors may detect vibration anomalies in pumps, early water leaks, or thermal inefficiencies, triggering alerts and preventive action before a major failure.

Virtual Tours, Augmented Reality & Remote Inspections

Virtual reality (VR) and augmented reality (AR) tools help prospective tenants tour spaces remotely, visualize potential interior modifications, or simulate renovations. This accelerates leasing decision cycles and reduces physical visits.

Drones and 3D scanning are also used to inspect roofs, facades, or large assets, improving the speed and safety of inspections.

Blockchain, Smart Contracts & Tokenization

In advanced scenarios, blockchain and smart contracts automate lease execution, payments, and escrow functions. Smart contracts can trigger rent payments or penalty adjustments based on predefined conditions without manual invoicing.

Tokenization enables fractional ownership, making real estate more liquid and democratizing investment access.

Data Analytics & Forecasting

Management firms use analytics to forecast rent trends, vacancy risks, maintenance cost escalation, and tenant churn. Machine learning models help identify underperforming assets and guide strategic decisions.

Analytics also support dynamic rent pricing or adjustment strategies to optimize yield across market cycles.

Real-World Use Cases & Example Firms

Below are well-known companies or use-case scenarios representing successful real estate management businesses or practices. Each example highlights how operations, technology, and strategy come together.

Example 1: Greystar Real Estate Partners

Greystar is one of the largest real estate management and development firms globally. It manages hundreds of thousands of residential units across multiple countries. Their scale allows them to deploy centralized systems, best practices, data analytics, and economies of scale.

They use tenant portal apps for communication and maintenance requests, optimize leasing strategies regionally, and invest in amenities and upgrades to maintain competitive positioning in rent and occupancy. Their management practices help maintain high retention rates and stable cash flows.

Example 2: Commercial Property Management by a Regional Firm

Consider a regional commercial property management firm overseeing multiple office buildings. They coordinate tenant improvements (TI), manage common area maintenance (CAM) charges, negotiate leases, and maintain building systems (elevators, HVAC, security).

They deploy building management systems for lighting, HVAC, energy tracking, and tenant comfort. Their management team forecasts capital replacement (roofs, chillers) across their portfolio, optimizing when to refurbish vs delay, balancing cost and tenant relations.

Example 3: Mixed-Use Property Management Business

A mixed-use property management business oversees a property combining retail at ground level, offices above, and residential units. They must integrate different leasing models, tenant types, maintenance regimes, and billing structures.

They use unified software to track lease agreements across varied asset types, coordinate maintenance across domain boundaries (e.g., a water leak affecting both retail and residential areas), and offer a tenant services portal that handles payments, maintenance requests, and notices. The ability to manage complexity is what makes this business model valuable to asset owners.

Example 4: Technology-Driven Boutique Management Firm

A smaller firm differentiates itself by using cutting-edge tech: offering tenant apps, IoT-based preventive maintenance, remote inspections using drones, automated billing and payments, and real-time dashboards for landlords.

Because of tech efficiency, this business can operate with lower overhead, service more properties per manager, and offer more transparency to owners, making it attractive for owners seeking high-performing, modern management.

Benefits & Advantages of a Well-Run Real Estate Management Business

Operational Efficiency & Cost Optimization

With streamlined processes, automation, centralized platforms, and proactive maintenance, management businesses reduce waste, duplicate effort, and unnecessary costs. They can negotiate better vendor contracts with scale and monitor performance closely.

Scalability & Portfolio Growth

When systems, processes, and infrastructure are standardized, the business can scale to manage more properties without linear growth in overhead. This means higher margins at scale.

Value Creation for Owners

By maintaining or increasing net operating income (NOI) through rent optimization, expense control, and capital upgrades, the management business increases investor returns and property valuations.

Risk Mitigation & Compliance Assurance

Professionally managed properties face lower legal, safety, and regulatory risks. With built-in audits, safety reviews, and compliance procedures, liabilities are minimized.

Enhanced Tenant Experience & Retention

Responsive maintenance, clear communication tools, amenities, and transparent billing contribute to tenant satisfaction. Higher retention reduces vacancy costs and turnover expense.

Data-Driven Decision Making

Access to analytics, market trends, and internal performance metrics helps the management business and owners make informed strategic decisions (when to upgrade, reposition, or lease adjust).

Competitive Differentiation & Reputation

Firms that adopt technology and deliver reliable services differentiate themselves in a crowded market. This attracts more clients (property owners) and enables premium management fees or incentive agreements.

Use Cases: Real Problems Solved by Real Estate Management Businesses

Use Case 1: Reducing Tenant Turnover & Vacancy

Problem: A building suffers high tenant turnover due to delays in maintenance, poor responsiveness, or unclear billing. Vacancy reduces revenue and raises marketing costs.

Solution: The management business implements tenant request portals, automated maintenance workflows, clear communication, and periodic check-ins. Tenants feel heard and stay longer, reducing downtime.

Use Case 2: Preventing Costly System Failures

Problem: An HVAC or plumbing system fails unexpectedly, causing disruption, repair cost spikes, and tenant complaints.

Solution: IoT sensors detect anomalies, early leaks, pressure changes, and temperature drift and generate alerts. The management business schedules preventive maintenance before catastrophic failure, avoiding high costs and tenant disruption.

Use Case 3: Managing Diverse Asset Types in One Portfolio

Problem: A property owner holds residential, commercial, and retail assets. Managing each with separate teams causes inefficiency and data silos.

Solution: The management business implements a unified property management platform to consolidate leases, billing, maintenance, and reporting across property types. This reduces duplication and makes portfolio-level oversight possible.

Use Case 4: Optimizing Capital Projects & Reinvestment

Problem: Aging infrastructure (roofs, elevators, façades) requires large capital outlays. Owners hesitate due to cost and disruption.

Solution: The management business phases investments based on lifecycle data, forecasts ROI, and minimizes tenant disruption by scheduling work during off-hours. They present pro forma outcomes to owners showing increased rental income or reduced maintenance from upgrades.

Use Case 5: Ensuring Regulatory Compliance & Safety

Problem: A building in a jurisdiction introduces updated fire safety or accessibility regulations. The owner risks fines or forced retrofit.

Solution: The management business monitors local regulatory changes, conducts internal audits, coordinates upgrades, and ensures all documentation and inspections are current, keeping the asset legally compliant.

Best Practices & Strategic Tips

-

Standardize workflows, documentation, and training across your team.

-

Invest in robust property management software and integrate systems.

-

Use predictive maintenance, IoT, and analytics to shift from reactive to proactive operations.

-

Maintain strong communication with owners and tenants. Transparency builds trust.

-

Budget for long-term investment (CapEx) rather than deferring maintenance.

-

Track key metrics (occupancy, turnover cost, expense ratio, maintenance backlog).

-

Build a network of reliable vendors, contractors, and specialists.

-

Stay current on regulatory changes and local market dynamics.

FAQs

Q1: Is launching a real estate management business capital-intensive?

Not necessarily. The biggest investments are in technology, skilled staff, licensing, and marketing. You can begin managing a few properties and scale gradually. Efficiency and reputation matter more than size initially.

Q2: How does the management business charge fees?

Typically, a base property management fee is taken as a percentage of monthly rent (e.g., 5–10%) or a fixed monthly fee. Additional revenue may come from leasing commissions, maintenance markups, or incentive fees tied to performance.

Q3: How critical is technology for a successful real estate management business?

It is vital. Without technology central platforms, automation, sensors, and analytics operations become manual, error-prone, and unscalable. Tech enables transparency, efficiency, and data-driven decisions that differentiate top firms.