Industrial Real Estate Brokerage Roles, Strategy & Use Cases

Industrial real estate brokerage is a specialized domain of commercial real estate that focuses on the sale, lease, and advisory services for industrial properties, warehouses, distribution centers, manufacturing plants, flex spaces, logistics hubs, and more. Given the technical, operational, and capital-intensive nature of industrial assets, brokerage in this sector demands deep domain expertise, strong networks, and strategic insight.

In this article, we will unpack what an industrial real estate broker does, how the brokerage business operates, the role of technology in modern brokerage, real-world examples and use cases, benefits for clients, practical problems solved, and common questions.

What Is Industrial Real Estate Brokerage & Why It Matters

Defining Industrial Real Estate Brokerage

An industrial real estate brokerage firm or broker represents parties in transactions involving industrial assets. Their clients may include property owners (landlords, developers), institutional investors, operators (third-party logistics, manufacturers), or tenants seeking space. The brokerage role encompasses sourcing listings, marketing, deal structuring, lease negotiations, site selection advisory, due diligence oversight, and closing coordination.

Because industrial properties carry special requirements such as floor load capacity, clear height, power infrastructure, dock doors, trucking access, and environmental compliance, brokers in this niche must understand engineering, supply chain logistics, infrastructure, and industrial market dynamics, beyond typical real estate principles.

Significance & Value Add

Industrial brokerage brings value by reducing information asymmetry, accelerating transactions, optimizing deal terms, and managing risk. A broker with deep industrial knowledge can vet prospective tenants or buyers, structure leases or purchase agreements to balance risk and reward, and anticipate issues that non-specialists might overlook.

Moreover, industrial real estate currently experiences tailwind growth in e-commerce, demand for last-mile logistics, and supply chain reshoring, making it one of the most sought-after asset classes. Skillful brokerage enables stakeholders to capture value in evolving markets.

Core Services & Brokerage Operations

Property Listing & Marketing

Once an industrial asset enters the market (for sale or lease), the broker crafts a marketing package detailing technical specifications: square footage, clear height, bay dimensions, dock configuration, column spacing, power capacity, site acreage, ingress/egress, expansion potential, zoning, and utility access.

Marketing channels include industrial real estate platforms, proprietary broker networks, industry events, direct outreach to logistics/industrial operators, and data-driven prospecting. Brokers must match property attributes with tenants’ operational needs to find suitable prospects efficiently.

Site Search & Tenant Matching

On the tenant or buyer side, brokers understand client requirements, location priorities, truck access, power needs, clear height, lease duration, project timeline, and curate a shortlist of suitable industrial properties. They negotiate site visits, coordinate inspections, and help clients visualize fit-outs or expansions.

A broker’s network and market intelligence are assets: they may know off-market opportunities or sublease possibilities not visible to general market audiences.

Deal Structuring & Negotiation

Industrial property deals often include complex clauses: base rent, escalation, tenant improvements (TI), landlord build-out, expansion rights, renewal options, common area maintenance (CAM), exclusivity or use restrictions, operating cost allocation, performance guarantees, and environmental indemnities. Brokers must negotiate these to align with the client’s risk profile.

A skilled broker frames proposals, counters terms, models financial impacts (e.g., TI amortization, occupancy ramps), and ensures clarity in responsibilities, liability, and exit conditions. Their experience helps avoid hidden pitfalls.

Due Diligence & Transaction Management

Once terms are agreed, the broker coordinates due diligence: structural inspections, environmental site assessments, power utility studies, drainage and grading, access rights, survey, permitting, and zoning confirmation. They liaise with engineers, environmental consultants, attorneys, legal, and financing parties to ensure conditions are met.

The broker also tracks timelines, handles contingencies, reviews legal documents, and guides toward closing or lease commencement. They often become the project manager for the transaction, ensuring nothing slips through.

Advisory & Portfolio Services

Many industrial brokerage firms offer advisory services, portfolio optimization, asset repositioning, redevelopment, sale-leaseback structuring, or industrial expansion strategy. They may advise owners on upgrading assets (adding power, increasing ceiling height, subdividing), repurposing underused land, or choosing markets for new development, leveraging their transactional insight and market data.

Technology in Industrial Real Estate Brokerage

Modern industrial brokers leverage technology to improve speed, precision, marketing reach, and decision-making. Below are key tech areas:

Market Intelligence & Analytics

Brokers use platforms that aggregate rent comps, vacancy trends, supply pipeline, transportation networks, labor markets, and demographic shifts. Machine learning models help forecast where industrial rent growth will occur, which markets are overbuilt, and where demand is accelerating.

This intelligence assists in advising clients on market entry, timing for disposition, or value-add potential.

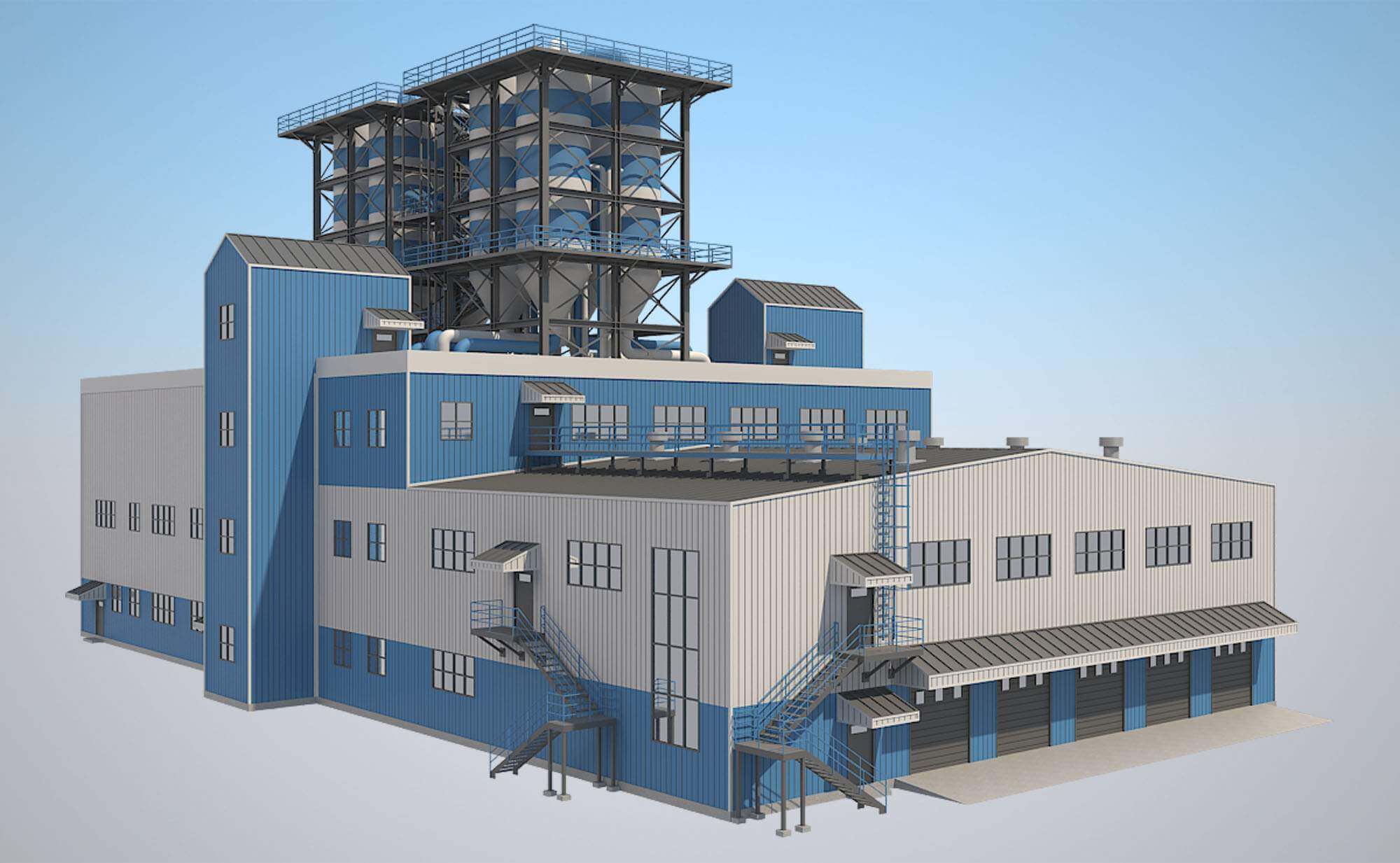

Virtual Tours, 3D Modeling & Digital Visualization

Industrial properties are often large and empty when marketed. Virtual tours and 3D models allow prospective tenants or buyers to explore the space remotely and visualize the layout. Brokers can overlay racking systems, drive aisles, loading docks, or automation lines to help operators assess fit before physical visits.

Digital twins (virtual replicas) can simulate operations, loading flows, or expansion scenarios, enabling clients to test ideas before committing capital.

GIS & Mapping Tools

Mapping software with overlays of transport routes, labor catchments, utility maps, and constraints (flood zones, easements) enables brokers to filter and rank candidate sites quickly. Brokers can visualize trade areas, proximity to highways, supply chain nodes, and estimate logistics cost implications for tenants.

CRM & Deal Pipeline Management

Industrial brokerage firms manage large volumes of leads, proposals, listings, and deals. A specialized commercial real estate CRM tracks prospects, transaction stages, follow-ups, document versions, and performance metrics. Automation helps send reminders, template proposals, and maintain pipeline hygiene.

Drone Surveys & Aerial Imaging

Insert image of drone survey of industrial park.

Drones and aerial imaging tools are used to survey large properties: roof conditions, site grading, drainage, access roads, and site context. These insights inform marketing visuals, due diligence, and site planning. Drones reduce time and risk compared to manual inspections.

Contract Automation & Digital Workflow

Digital document platforms help brokers generate proposals, letters of intent (LOIs), lease drafts, and amendments, with version control, audit trails, and e-signature support. Workflow automation ensures deadlines, lease renewals, and deliverables are tracked and nothing is missed.

Real-World Brokerage Examples & Use Cases

Example 1: Large-Scale Logistics Park Brokerage

A brokerage engages with a developer constructing a multi-building logistics park. The broker markets each building sequentially, securing pre-leases with large distribution firms. They coordinate build-to-suit specifications, negotiate long-term leases with escalations, and stage infrastructure buildouts in phases.

Their ability to match tenants across multiple units, negotiate contiguous expansion options, and coordinate infrastructure has a material impact on development feasibility and land value.

Example 2: Suburban Flex / Light Industrial Spaces

An industrial broker focuses on the flex market, the smaller units combining warehouse and office. Their tenants might include e-commerce micro-fulfillment, light manufacturing, or service businesses. The broker markets proactively to local operators and designers, assists with layout optimization, and negotiates flexible lease terms.

Their local relationships and understanding of smaller-scale industrial needs make them more effective than generalist brokers.

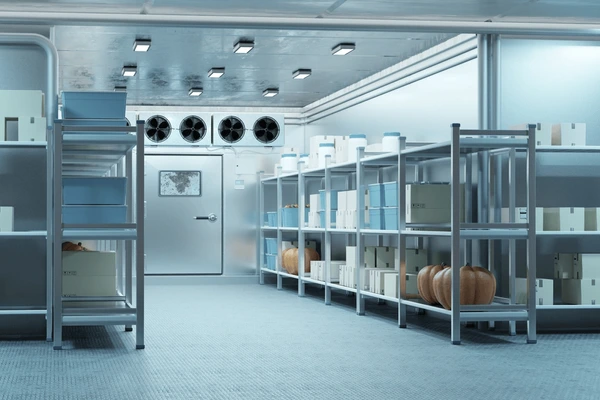

Example 3: Cold Storage & Temperature-Controlled Brokerage

Cold storage space demands specialized infrastructure, refrigeration, bacpowerndand r,humidity control. An industrial brokerage firm operating in this niche market, such as properties to food distributors, pharma logistics, and perishables supply chains. They negotiate service-level agreements (SLAs), uptime guarantees, and energy cost pass-through structures.

Because the barrier to entry is high, these brokers can command premium fees and attract niche clients.

Example 4: Repurposing Obsolete Industrial Assets

An older, underperforming industrial building lacks modern, clear heights or power. A brokerage advises the owner on repositioning, subdividing, adding mezzanines, or upgrading utilities. They then market the upgraded product. Through leasing or sale, the brokerage helps unlock hidden value by converting “obsolete” space into demand-ready industrial real estate.

Benefits & Advantages of Using an Industrial Real Estate Brokerage

Access to Deep Market Knowledge & Networks

Specialist brokers have relationships with industrial operators, tenants, supply chain firms, and developers, enabling quicker deal matching and access to off-market opportunities. Their domain knowledge leads to a better property-tenant fit.

Faster Deal Velocity & Reduced Vacancy

Because brokers bring credible prospective tenants quickly, they help reduce downtime and vacancy. Their marketing approach, aligned with tenant needs, accelerates absorption in competitive markets.

Risk Reduction & Due Diligence Support

Industrial brokerage helps clients avoid pitfalls environmental contamination, utility shortfalls, structural issues, and zoning constraints, by coordinating due diligence teams and vetting properties professionally.

Optimized Lease & Sale Terms

Brokers structure deals with favorable terms, negotiate improvements, escalation, expansions, and risk protections. Their experience helps balance landlord and tenant interests to facilitate long, stable leases or profitable sales.

Value Creation & Asset Enhancement

By identifying repositioning strategies, advising on upgrades, and matching tenants who pay premiums, brokers can boost net operating income (NOI) and capital value. Their advisory role is key to long-term asset stewardship.

Scalability & Efficiency via Technology

Through tech adoption, brokerage firms can handle more listings, prospects, and markets without linear staffing growth. Automation, analytics, and visualization increase productivity and service quality.

Use Cases: Problems Solved by Industrial Real Estate Brokerage

Use Case 1: Developer Needs Pre-Lease in Logistics Project

Problem: A developer building new warehouses must secure pre-leases to justify financing and attract investors.

Solution: The industrial brokerage markets the project early, sources prospective tenants, negotiates pre-lease agreements with build-to-suit terms, and stages infrastructure in sync with tenant commitment.

Use Case 2: Tenant Seeking Optimal Distribution Location

Problem: A growing e-commerce company needs an efficient distribution location to minimize delivery costs.

Solution: The broker evaluates multiple markets, trade-offs in land cost vs transport cost, site feasibility, and ultimately presents options with financial modeling. The tenant selects a site aligned with the logistics strategy.

Use Case 3: Underutilized Asset Requires Repositioning

Problem: A landlord owns an obsolete industrial building with low occupancy and limited demand.

Solution: The brokerage recommends upgrades (floor strengthening, additional power, loading improvements), redevelops marketing narrative, and repositions the asset to attract modern tenants, creating new demand and lift in occupancy.

Use Case 4: Cold Storage or Specialized Industrial Demand

Problem: A tenant demands cold storage capabilities or high-power infrastructure not widely available in generic industrial parks.

Solution: The broker identifies niche assets, models cost implications, secures lease terms with contingencies, and positions the building’s specialization to justify higher rent.

Use Case 5: Cross-Market Expansion for Tenant

Problem: A logistics firm wants to expand into a foreign or distant market but lacks local presence.

Solution: The industrial brokerage firm uses its regional network, local site knowledge, regulatory contacts, and transaction experience to guide the tenant’s entry, site selection, lease negotiation, and setup.

Best Practices & Strategic Guidance

-

Maintain deep specialization; industrial nuance matters more than general commercial knowledge.

-

Develop and invest in technology: GIS, analytics, drone imaging, CRM, virtual tours.

-

Build and maintain strong networks with industrial occupiers, 3PLs, manufacturers, and infrastructure providers.

-

Always perform rigorous due diligence on environmental, structural, and utility fronts.

-

Structure deals clearly with flexible but protective lease clauses.

-

Position industrial properties for upgrades or repositioning.

-

Market proactively uses data, outreach, and content to stay visible.

-

Track deal metrics, pipeline health, conversion rates, and listing performance.

FAQs

Q1: How does industrial real estate brokerage differ from general commercial brokerage?

Industrial brokerage demands technical knowledge (power, structural load, site access, logistics) and deeper relationships in ithe supply chain and industrial sectors. General commercial brokerage covers offices, retail, and hospitality, with different demands and tenant types.

Q2: What industries or tenants do industrial brokers usually work with?

Common tenants include third-party logistics (3PLs), e-commerce distributors, manufacturers (light and heavy), cold chain operators, automotive suppliers, processing firms, and last-mile fulfillment centers.

Q3: How do industrial brokers charge fees?

Brokers typically receive commission on lease value (a percentage) or on sale price. For complex, high-value transactions, they may also negotiate tiered or incentive-based compensation tied to performance or speed.