Nuveen Industrial Real Estate Global Strategy, Technology & Market Insights

Nuveen Industrial Real Estate represents one of the most strategic and forward-thinking segments of Nuveen Real Estate, a global real estate investment manager with a vast portfolio exceeding $150 billion in assets under management.

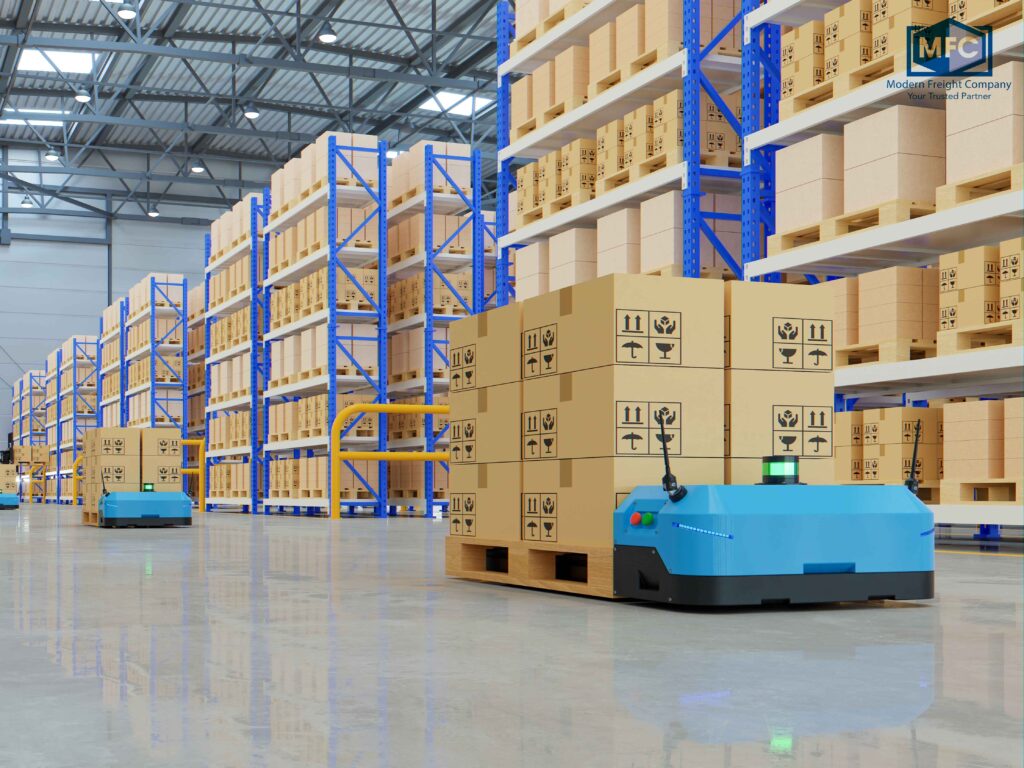

As global supply chains evolve and e-commerce continues to expand, industrial assets have become one of the most sought-after property classes. Nuveen has positioned itself as a leader in this space by developing, acquiring, and managing industrial and logistics properties across key global markets.

This article provides an in-depth exploration of Nuveen Industrial Real Estate, including its global investment strategy, sustainability focus, use of technology, and notable case studies.

Understanding Nuveen Industrial Real Estate

Overview of Nuveen Real Estate

Nuveen Real Estate is the investment arm of TIAA (Teachers Insurance and Annuity Association), with operations spanning across North America, Europe, and Asia-Pacific. Its industrial division focuses primarily on logistics, warehousing, manufacturing, and distribution assets critical components of the modern economy.

The company’s industrial portfolio is designed around long-term value creation. Rather than simply owning buildings, Nuveen actively manages and enhances these properties using data analytics, sustainable design, and modern tenant engagement tools.

The result is a real estate strategy that balances income stability, capital appreciation, and environmental stewardship.

The Rise of Industrial Real Estate as a Core Asset Class

Industrial real estate has transitioned from being a niche investment to a global powerhouse sector. The growth of e-commerce giants, the reshoring of manufacturing, and the last-mile delivery networks have dramatically increased demand for modern logistics hubs.

Nuveen identified this shift early and strategically expanded its industrial footprint to capture growth opportunities in key logistics corridors from U.S. inland hubs to European distribution centers and Asia-Pacific trade gateways.

This foresight positioned Nuveen among the world’s top institutional players in industrial property investment.

Nuveen’s Global Industrial Investment Strategy

Focus on Core Logistics Hubs

Nuveen targets strategically located properties in major trade, population, and transportation corridors such as Los Angeles, Chicago, London, Rotterdam, and Singapore.

These areas serve as central logistics nodes for both domestic and international goods movement. By investing in proximity to ports, airports, and highway networks, Nuveen ensures strong tenant demand and minimal vacancy risk.

The strategy also emphasizes build-to-core developments, acquiring land in growth zones, and developing purpose-built facilities that align with modern tenant requirements (high ceilings, automation readiness, ESG compliance).

Diversification Across Geographies and Sectors

Nuveen’s industrial portfolio includes:

-

Large-scale logistics parks

-

Urban last-mile distribution centers

-

Light manufacturing and assembly facilities

-

Cold storage and temperature-controlled assets

This diversified structure reduces exposure to single-market volatility and allows the company to serve a broad range of tenant industries from retail and automotive to food, pharma, and technology.

Sustainable and Resilient Investing

Sustainability is a cornerstone of Nuveen’s real estate philosophy. Its industrial properties are designed to meet or exceed LEED, BREEAM, or NABERS standards, incorporating energy-efficient lighting, smart HVAC systems, solar installations, and water recycling.

By combining sustainability with technology and operational efficiency, Nuveen creates industrial spaces that attract high-quality tenants, reduce operational costs, and improve long-term asset resilience.

Technology Integration in Nuveen Industrial Real Estate

Smart Building Technology

Nuveen integrates smart systems and IoT devices across its industrial portfolio. These systems monitor building performance in real-time, tracking temperature, air quality, energy usage, and mechanical health.

Managers can predict maintenance needs, optimize energy consumption, and automatically adjust building systems for maximum efficiency. The result is a data-driven property ecosystem that improves reliability and sustainability.

Artificial Intelligence and Predictive Analytics

AI and predictive analytics help Nuveen analyze tenant behavior, rental trends, and maintenance patterns across regions. This technology allows for accurate forecasting of lease renewals, rent growth, and asset valuations.

AI-based maintenance algorithms can even detect equipment wear or performance deviations, triggering early maintenance before costly breakdowns occur, minimizing downtime for tenants in logistics or manufacturing sectors.

Data Platforms and Tenant Experience Tools

Nuveen uses advanced asset management platforms that integrate leasing, accounting, maintenance, and ESG performance tracking.

Tenants can interact via digital portals to report maintenance issues, monitor energy usage, or request space modifications, streamlining communication and transparency between landlord and tenant.

Drones and Automation for Property Oversight

Nuveen utilizes drone technology for property inspections, roof monitoring, and site mapping. This reduces human risk and accelerates inspection accuracy, particularly across large logistics parks or construction sites.

Automation tools also play a role in facility management, from smart lighting systems to automated gate access and real-time security monitoring.

Real-World Examples of Nuveen Industrial Real Estate Projects

Example 1: Nuveen’s U.S. Logistics Portfolio

In the United States, Nuveen owns and manages millions of square feet of industrial space across key logistics corridors such as Atlanta, Dallas, Chicago, and Southern California.

Many of these properties feature advanced sustainability systems, including solar power, motion-sensing lighting, and EV charging stations, aligning with Nuveen’s carbon-reduction goals.

Relevance:

This portfolio demonstrates Nuveen’s ability to integrate operational efficiency with ESG priorities while catering to the growing logistics and e-commerce market. The properties’ strategic proximity to major ports and highways ensures steady demand and long-term stability.

Example 2: Nuveen’s European Logistics Expansion

Nuveen has expanded aggressively in Europe, with a focus on the Netherlands, Germany, France, and the U.K. These markets act as critical entry points for goods flowing across the continent.

Facilities are designed to support modern logistics operations, including automation, robotics, and green building systems. Many of them serve multinational tenants, ranging from global retailers to automotive suppliers.

Relevance:

The European portfolio highlights Nuveen’s expertise in cross-border logistics and its ability to adapt to regional regulations and sustainability standards while maintaining investor-grade performance.

Example 3: Asia-Pacific Industrial Developments

Nuveen Real Estate’s Asia-Pacific division manages logistics developments in Japan, Singapore, Australia, and South Korea regions with strong trade connectivity and limited land supply.

These assets cater to global supply chains, housing distribution centers for e-commerce and manufacturing clients. Facilities often feature multi-level warehouse designs, automation-ready infrastructure, and on-site green energy systems.

Relevance:

This demonstrates Nuveen’s long-term commitment to capturing growth in emerging logistics markets and meeting rising demand for sustainable, high-tech industrial spaces in Asia-Pacific.

Example 4: Cold Storage and Temperature-Controlled Facilities

Nuveen has invested in specialized cold storage facilities, essential for food distribution, pharmaceuticals, and biotechnology sectors. These facilities include advanced refrigeration systems, energy recovery units, and redundant backup systems for safety.

Relevance:

Cold storage properties are one of the fastest-growing segments of industrial real estate. Nuveen’s early entry into this market allows it to capitalize on the increasing demand for reliable and energy-efficient temperature-controlled supply chains.

Benefits and Practical Advantages

Long-Term Portfolio Resilience

Industrial properties tend to generate stable income due to long lease terms and strong tenant retention. Nuveen’s strategy of selecting prime locations and high-quality tenants enhances resilience against market downturns.

Technology-Driven Efficiency

Nuveen’s use of smart building systems, predictive maintenance, and ESG reporting tools reduces operating costs, increases uptime, and enhances transparency. These efficiencies translate into stronger investor confidence and better net operating income (NOI).

ESG Leadership and Investor Appeal

By embedding sustainability into its assets, Nuveen aligns with institutional investors’ growing demand for ESG-compliant portfolios. The firm’s commitment to green certifications and renewable energy not only improves environmental outcomes but also strengthens asset value over time.

Market Access and Global Diversification

Nuveen’s presence across continents offers exposure to multiple economies and currencies, reducing concentration risk and enhancing portfolio balance. This global diversification helps stabilize returns in fluctuating economic environments.

Use Cases: Real-Life Problems Solved by Nuveen Industrial Real Estate

Use Case 1: Supply Chain Optimization

Problem: Global e-commerce retailers face bottlenecks due to outdated logistics infrastructure.

Solution: Nuveen develops strategically located, automation-ready warehouses that enable faster order processing, reducing delivery times and improving supply chain efficiency.

Use Case 2: Energy Cost Reduction

Problem: High energy consumption in large warehouses leads to rising operational costs.

Solution: Nuveen installs solar panels, LED lighting, and smart HVAC systems to reduce power usage and cut carbon emissions — benefiting both tenants and investors.

Use Case 3: Tenant Retention and Satisfaction

Problem: Industrial tenants often leave properties due to inefficiency and poor facility management.

Solution: Through data-driven maintenance and tenant portals, Nuveen enhances communication, ensures proactive repairs, and creates long-term tenant partnerships.

Use Case 4: Capital Growth and Value Preservation

Problem: Investors seek inflation-hedged, income-producing assets.

Solution: Nuveen’s industrial portfolio provides consistent rent growth, inflation-linked leases, and high-quality tenant covenants that preserve and grow capital value.

Strategic Insights for Investors

-

Focus on core logistics hubs where demand exceeds supply.

-

Prioritize assets with ESG credentials and sustainable operations.

-

Adopt PropTech and analytics tools to improve operational visibility.

-

Diversify across regions and asset types to reduce concentration risk.

-

Build long-term partnerships with reliable tenants.

FAQs

Q1: What makes Nuveen Industrial Real Estate stand out in the market?

Nuveen combines global scale, sustainability leadership, and advanced technology to manage high-performing industrial portfolios that deliver consistent returns and ESG compliance.

Q2: Does Nuveen focus only on large industrial facilities?

No. While it owns large logistics parks, Nuveen also invests in last-mile distribution centers and specialized facilities like cold storage and manufacturing hubs.

Q3: How does technology improve Nuveen’s industrial portfolio performance?

Smart systems, IoT, and predictive analytics reduce energy use, automate maintenance, and provide real-time data for decision-making, resulting in lower costs and better tenant retention.

Conclusion

Nuveen Industrial Real Estate exemplifies how modern property management, technology, and sustainability can merge into a high-performing, future-proof investment strategy. With a global footprint, diversified assets, and a strong ESG foundation, Nuveen continues to set the benchmark for excellence in industrial real estate investing.

Its approach not only creates financial value but also supports global trade, innovation, and environmental stewardship, shaping the next generation of industrial property investments.